But, before you go for the article, make sure you help spread this newsletter to your friends and family!

The stock market can be very volatile, but 90% down in 1 day? Wow…

1- What has been Nvidia's performance?

Nvidia as a company and stock has been on a tear for the past 18 months:

Revenue is up from $6B in Q4 2022 to $26B in Q1 2024 (staggering growth of 433%!);

Net income (profit) is up more than 10x (1,000%)!!!

At the same time, the stock is up 730%

2- What was the drop?

Yes, dozens of readers, Nvidia is down 90% from its ALL-TIME-HIGH reached last Friday, 7th of June.

At last Friday's close, the stock had reached $1,208 per share. On Monday, at market opening, it was trading at $120 a share.

3- Did the BUBBLE BURST?

Well, not really. Nvidia did not lose any value at all; what happened was what we call a stock split. Our most financially fanatic readers will know what that is… but, if you don't, let me break it down:

Every investor that had 1 Nvidia stock on Friday at close, was “gifted" another 9 shares over the weekend and, on Monday morning, he saw 10 times more Nvidia shares in his portfolio.

4- What is a Stock Split?

Before we go into the definition of “stock split", let us understand what a company's market cap is:

MARKET CAP (or market capitalization) is the value of a publicly listed business, calculated by multiplying its share price by the amount of shares outstanding.

EXAMPLE:

Let's say company A has 1 million shares available to be openly traded in the market and each share is valued at $50. So, it's market cap is $50 x 1,000,000 = $50,000,000. So, the company's market cap is $50M. (Obs.: it's a simplified explanation without considering the intricacies of cash, debt, or goodwill in the balance sheet).

Now, let's say the same company A is going through a 5 to 1 stock split - for every share, another 4 will be “gifted” to the shareholders. BUT, as the company value should remain unchanged (remember, a stock split in itself does not create real value!), as you have 5 times more shares, the value of each share should be:

Share value = Market Cap / number of shares outstanding

New share value = $50M / (5 x 1,000,000) = $10

So, is the stock down 80% (from $50 to $10)? NOOOO! A stock split has happened.

5- So, why do a stock split?

In theory, there would be no reason for a stock split, especially now, when many brokerage firms offer trading in fractional shares (you don't need to buy 1 whole share - many offer the functionality to buy 0.1 share, for example).

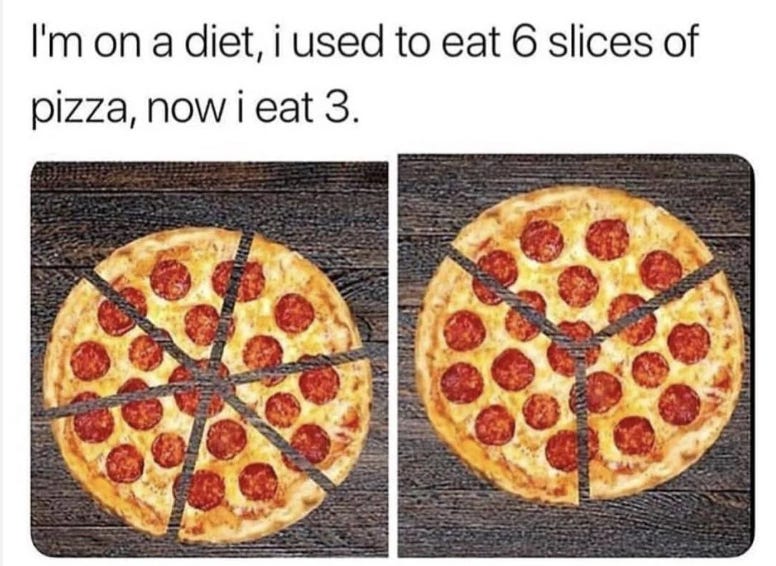

That's why so many people say it should be considered a NON-EVENT by serious investors. It is like having a waiter ask you how many slices you would like your pizza to be cut in and you say: “please slice it in 4 because I couldn't possibly eat 6 or 8!"

The pizza size (Market Cap) is still the same, despite the number of slices (shares outstanding).

But, there are a few reasons why a Company chooses to go for a stock split:

a lower share price can influence some retail investors (subconsciously) to buy the stock. Apparently, many people feel more comfortable buying a $100 stock than a $1,000 stock;

a lower share price can help the company democratize stock-based compensation for more employees - there is a higher probability that lower-paid employees can get stock options if the price is lower and more compatible with their salaries; (For me this is the real valid reason for a stock split nowadays)

some companies try to enhance their stocks liquidity but increasing the number of shares being traded - a cheaper price also helps in that sense;

some indices, like the Dow, are stock-price weighed, not market cap weighed (like the S&P500, or FTSE 100) - so, a cheaper stock price makes an inclusion in the index more likely. (But, no one really cares about the Dow anyways, so…)

5- Disclaimer

This is the boring part where I tell you this newsletter is not investment advice, it is just informative and expresses the views of the author on the matters discussed.

Talk to a professional (me!) before you decide on the best course of action and financial plan for your future.

And, don't for get to…